Do you need to sell an inherited home in Texas?

Every day in Texas, families are faced with the difficult decisions that come with the loss of a loved one. Among the most challenging and time-consuming is navigating the murky waters of probate, when the departed family member has left behind a home that they owned. The family may be left wondering if they can sell the house in probate in Texas.

In this guide, we want to help you better understand the process of selling an inherited house out of probate in Texas. We will review the laws and regulations that dictate what needs to be done, and walk you through the steps you’ll need to take. Our goal is to help you make the process of selling a Texas house out of probate as simple as possible.

As with any situation involving property and the courts, you may want to consult an attorney. The State Bar of Texas offers an online lawyer directory; find a link at the bottom of this article.

With that in mind, let’s take a look at the probate real estate-selling process, and what you’ll need to know.

Quick Reference

- Do you need to sell an inherited home in Texas?

- What is Probate?

- How Much Does Probate Cost?

- What is the Probate Process in Texas?

- Can I sell an Inherited House Without Going Through Probate?

- What is a Muniment of Title Probate?

- Who Is Responsible for the House During Probate?

- Can I Sell a House During Probate?

- What Happens to the House if There is No Will?

- Conclusion

- Frequently Asked Questions

What is Probate?

Probate is the American legal process designed to ensure that the property of a person who has died is distributed fairly.

To put it another way: “probate” refers to the court system that settles the estate of the person who died.

In Texas, probate is handled by a court system. There are 18 statutory probate courts statewide, with nearly half of those in the Dallas / Fort Worth area alone. However, each of Texas’ 254 counties has its own County Clerk that can assist with probate claims. You can find your Texas county clerk’s office here.

A common probate situation is when a single or widowed person passes on, and their children or siblings are their heirs. Heirship can be determined in advance, typically by a written will or living trust.

When it comes to real estate, probate is often necessary to ensure the title is legally transferred to the heir, even when there is a written will leaving the house to that person.

How Much Does Probate Cost?

This is a tricky question to answer, because it depends on many factors.

For example, a basic estate with a written will, no outstanding debts, and no disputes: the only cost might be a probate application filing fee. In Dallas County, this is $266.

But costs can add up quickly. If there’s no will, you may need to file an Application to Determine Heirship. Using Dallas County’s fee schedule, that’s another $311, plus a $400 deposit for a court-appointed attorney. If the estate includes a house that you wish to sell right away, you can throw in another $242 for an Application for Sale of Real Property.

Some estimates find probate in Texas costs about $1,500, on average. Your actual costs could be lower – or much higher, if you need to hire an attorney.

On top of that, there are also holding and carrying costs to consider when a house is in probate. As the executor or beneficiary, you may be financially responsible for the costs of keeping the house. That would include property taxes, property insurance, landscaping, basic maintenance and repairs, and, if no one is living in the house, security to prevent burglary and theft. Because probate can take anywhere from six months to two years, those costs can really add up.

DID YOU KNOW?

If the person who died was your spouse, and you both lived in Texas at the time of their death, you probably won’t need to worry about probate. Because Texas is a community property state, the surviving spouse will automatically take ownership of the deceased’s estate, unless otherwise specified in a will or the property deed / title. Talk to an attorney if you have questions.

What is the Probate Process in Texas?

If you want to sell a probate house in Texas, you’ll need to know how probate works. It is a crucial step in selling the property, and will be useful for settling any and all matters related to property left behind by the deceased.

Step 1: Apply for Probate

You’ll need to first file an application or petition for probate. You can do this at the office of the County Clerk in the county where the property owner lived at the time of death.

This can be complicated by various factors, such as multiple marriages and children, or having no spouse or children at all. If you believe you may be facing a contentious situation or dispute over heirship, you should consult an attorney.

Step 2: Public Notice

Once you’ve filed for probate, the court will schedule a hearing. For two weeks before the hearing, the court will post public notices online and at the courthouse about the probate application. This is to notify anyone who might wish to contest the will, or make a claim against the estate. (Again, if you learn the estate is being contested, you should seriously consider hiring an attorney.)

Step 3: The Hearing

A probate judge will preside at the hearing on the scheduled date. He or she will determine whether the person who died left a valid will. Then, the judge will approve of the executor named in the will, or appoint an administrator if there is no will, or if the named executor is unable to fulfill their duties.

Step 4: Listing the Estate’s Assets

The executor or court-appointed administrator has 90 days after the hearing to report all of the estate assets to the County Clerk. This is known as an Inventory, Appraisement, and List of Claims. Basically, the executor will create a written list of the personal property left by the deceased: real estate, vehicles, antiques, personal belongings, and so on. For certain assets, like real estate, the executor must provide an estimated value. (Yet again, if you’re dealing with a large or complicated estate – especially worth $1 million or more – you should talk to an attorney.)

Step 5: Identify the Heirs and Beneficiaries

This job is made so much easier for everyone involved if the departed left a valid will. In the absence of a will, the court will need to determine who gets what. (And in that case, what did we say about an attorney…?)

Step 6: Debt and Creditors

If the person who died had any outstanding debt – a mortgage, medical bills, a car loan, etc. – the executor must notify each lender / creditor. Those creditors can then file claims against the estate, to recover any money owed to them.

Step 7: Claims, Grievances, and Legal Disputes

In Texas, anyone can contest a will up to two years after it goes into probate. Hopefully, this won’t be an issue for you. However, if any family members or other possible beneficiaries decide to contest a will, you’ll need to prepare for a difficult and possibly drawn-out legal dispute. You know the drill by now: consult an attorney in this situation.

If you’ve made it through Steps 1 through 6 and managed to avoid (or prevail in) Step 7, probate is concluded and the remaining assets are distributed to heirs / beneficiaries after any debt claims are paid.

WHAT IF I INHERIT A HOUSE WITH A MORTGAGE?

If you inherit real estate with an outstanding mortgage, you may worry that you won’t be able to keep making payments, especially if you already own a home of your own.

Here’s some reassuring news: Local Cash Buyers can buy your inherited house fast, for cash – even if there is a mortgage. We can buy even if the payments are behind, because no one was making them after the homeowner died. Contact us today for a free, no-obligation consultation.

Can I sell an Inherited House Without Going Through Probate?

Suppose your loved one left behind a clear and simple will, leaving their house to you and you alone. You might be asking, “Can I sell my inherited house before probate?”

In Texas, with or without a will, you generally cannot handle inheritance of property without involvement of the court system. Attempting to do so can potentially expose you to tax penalties or legal trouble. When in doubt, contact an attorney.

Even if you’re the sole heir and executor of an estate, it’s a good idea to file the will with your county probate court. If you don’t, others who believe they are entitled to a share of the estate could sue you.

There is one method that somewhat bypasses the probate process: a Muniment of Title.

What is a Muniment of Title Probate?

If the deceased had a will, and a relatively basic estate, you might be able to simplify the probate process with a Muniment of Title.

With a Muniment of Title, there is no executor. Instead, all beneficiaries will fill out and sign paperwork stating that they agree with the will and its instructions. Once the court approves the will and determines there are no claims against it or other challenges, you can use a Muniment of Title to pass the ownership title of the house onto the appropriate heir or heirs.

Texas law allows the family to use a Muniment of Title Probate if these conditions are met:

- The deceased left a written, valid will

- The estate is only cash accounts, personal items, and real property (land and structures, such as a house)

- The estate does not include stocks, bonds, 401(k), or other investments

- The deceased had no outstanding debt or other liabilities

- There are no disputes over heirship / contests of the will

If you’re uncertain whether your situation allows for a Muniment of Title, contact your county clerk or a probate attorney.

Who Is Responsible for the House During Probate?

Ultimately, the executor or primary heir would assume responsibility for the house and its upkeep.

As we noted earlier, there are a number of costs associated with the house’s care during probate:

- Removal of personal property

- Cleaning

- Property taxes

- Property Insurance

- Supplemental insurance for a vacant / unoccupied home

- Utilities

- Lawn care / landscaping

- Basic maintenance / repairs

Who pays for it? Again, that could be determined by the executor or presumed heir, depending on who is expected to take ownership of the house.

Often, the family will want to sell the house. This could be because nobody wants to live in it, or because an agreement is reached for the house to be sold and proceeds divided among heirs. You might also need to use the proceeds to pay off debt claims against the estate.

In those scenarios, the family may want to sell the house quickly. Local Cash Buyers can help – we pay cash, full-price, for houses in probate. You do not need an appraisal, and no banks or lenders are involved. Please contact us today for a free, no-obligation consultation.

Can I Sell a House During Probate?

Generally, yes – you can sell a Texas house in probate, though it can take quite a bit longer than a traditional sale.

For the most part, this happens when there is a valid will that names an executor and specifies who receives the house.

It is possible to sell a house in probate without a will; we’ve provided details here.

When there is a will, the executor is responsible for selling the house, with the approval of the heirs. The executor may recruit a real estate agent or broker experienced in probate law to help with the sale. A formal appraisal may also be necessary.

The selling process isn’t quite like a traditional house sale. Offers must meet certain requirements, and be approved by the court:

- The final sale price must be at least 90% of the appraised value

- The buyer must pay a 10% deposit if their offer is accepted*

- A Notice of Proposed Action must be mailed to all heirs or claimants, informing them of the terms of the sale

- Anyone wishing to contest the terms of the sale has 15 days to do so

*Note: You will need to refund the deposit if you end up accepting a higher offer. The estate keeps the deposit if the buyer backs out for any other reason.

Once all those requirements are met, the executor or estate’s attorney applies for a court hearing. It will take place 30 to 45 days after application. During that time, the real estate agent can continue to show the home and try to get a better offer.

CAN I SELL A HOUSE IN PROBATE IN TEXAS WITHOUT AN AGENT?

If you decide to go it alone and list a house in probate without an agent, you’ll need to let all prospective buyers know that any sale will be subject to probate court approval. And, unless you want to spend your own money on repairs, you’ll be selling the house “as-is.” It’s possible all this could scare off some would-be buyers who are in a hurry or just don’t want to deal with extra legal layers. The process could take up to six months to complete.

Alternatively, you can sell your house in probate to an all-cash investor like Local Cash Buyers. There are no fees, and we can close in as few as 7 days after you accept our offer. We can buy your house as-is, even if major repairs are needed! Contact us today to reserve your free, zero-obligation consultation.

The day of the hearing is something like an auction. Anyone from the general public can attend the hearing and attempt to out-bid the offer already accepted by the estate. That’s right: a bidder may offer a better price during the court confirmation hearing. New bids must be at least 5 percent plus $500 over the original offer.

If another buyer makes a qualified offer at the hearing, they will need to provide a cashier’s check for at least 10 percent of the new price, or 10 percent of the first $10,000, plus 5 percent of the balance.

The court must accept the highest valid bid. Once that happens, escrow begins, and closing will take place about a month to 45 days later.

Because probate sales can be time-consuming, and because the house is generally being sold as-is without repairs or upgrades, it can be challenging to find a willing buyer. Most home-shoppers are looking to move in right away, and may not be willing to wait the many weeks or months it can take for a probate sale to complete. They may also be hesitant to make an offer, knowing someone can out-bid them at the last minute in the confirmation hearing. That’s why cash buyers and investors are often interested in buying homes in probate.

What Happens to the House if There is No Will?

Sadly, this is a common and complicated situation that families find themselves in every day.

Fortunately, Texas law is well-equipped to handle a no-will situation. It is very likely you will need to consult an attorney for help with an estate that has no will. Here is some of what you can expect:

First, you should know an estate without a will is definitely going to probate court. All the rules are set by the Texas Probate Code.

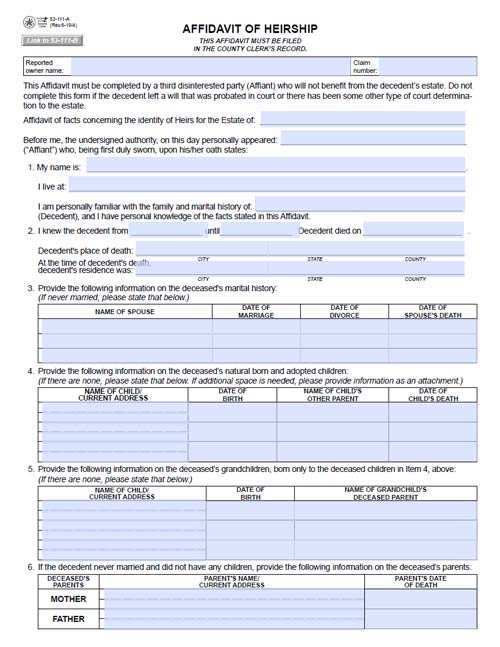

With concern to real estate, the title can be transferred to heirs through an Affidavit of Heirship.

Each heir should fill out the affidavit and have it signed and sworn by a notary public, in the presence of a witness who knew the deceased and who is not a family member. (In some cases, a family member can act as a witness if he or she does not stand to benefit from the estate and won’t be contesting it.)

The Affidavit(s) of Heirship must then be filed with the County Clerk where the deceased lived.

Even after you’ve filed it, the Affidavit of Heirship doesn’t finalize the transfer of the title. Instead, it is used as evidence in probate court, to determine who is entitled to the real estate in question.

Note: many title companies will not approve the transfer of title, even with a court-approved affidavit of heirship, until at least six months have passed following the death of the property owner.

If all of the above is confusing, it’s another great example of why you should consult a lawyer if there is no will.

Conclusion

Selling an inherited house during or after probate can add a lot of stress to an already difficult situation. We hope this guide has made things easier for you to understand, and better prepared you for the task at hand.

If you are thinking about selling your inherited house in Texas, we invite you to contact us for a free, no-pressure, no-obligation consultation. We buy homes in probate, even with an outstanding mortgage or lien, and even if the house is in need of major repairs.

Please note: this is a guide, not a substitute for legal advice. We are not attorneys and cannot offer legal advice of any kind. If you have questions, we encourage you to contact a probate attorney using the link below.

Resources and Further Reading

Texas State Bar Association – Find a Lawyer

Texas Estates Code

Texas Probate Guide

The Steps to Probating a Will in Texas

Dying Without a Will in Texas

Let Us Help You Sell Your Home in Probate.

We are experienced in buying inherited property and homes going through the probate process. We will make you a written, all-cash offer within 24 hours of a brief visit to your property, and we can close in as few as 7 days. Please fill out this form for a free, no-obligation consultation.Frequently Asked Questions

Probate is the legal process that ensures the property of a person who has died is distributed fairly. In general, any estate with real property – such as real estate – must go through probate after the owner dies.

There are 18 statutory probate courts in Texas, mostly in large cities; about half are in the Dallas / Fort Worth area. However, every Texas county has its own County Clerk that can assist you with probate claims.

Some estimates find probate in Texas costs about $1,500, on average. Costs can be much lower if there is a valid will, no outstanding debt, and no disputes over the will or heirship. Probate can cost much more if there is no will, or if you need to hire an attorney.

If your spouse dies, and you both lived in Texas at the time of their death, you shouldn’t need to worry about probate. Because Texas is a community property state, the surviving spouse will automatically take ownership of the estate, unless otherwise specified in a will or if the property had another co-owner.

You will need to file an application or petition for probate. You can do this at the County Clerk in the county where the property owner lived at their time of death.

This depends on two major factors: whether the deceased left a valid will, and the size of their estate. For a small estate (less than $75,000) with a will, it could take a few months. For larger estates with a contested will or no will, probate can take a year or longer.

In most cases, you must file for probate in order to sell an inherited house, even if there is a will and you are the sole heir. Contact a probate attorney if you need guidance.

A Muniment of Title is a document that expedites the probate process. It can be used if the deceased left a written, valid will; if the estate is only cash accounts, personal items, and real property; if the estate does not include investments; if there are no outstanding debts or liabilities; and if the will is not contested.

The executor of the will, or the primary heir, would be responsible for caring for a house during the probate process. If neither the executor nor an heir is able to care for the house, the probate court may appoint a caretaker.

Yes. However, this must be done with the oversight and approval of the probate court. The entire process can take up to six months to complete.

Yes, but you will need to let all prospective buyers know that any sale will be subject to probate court approval.

Yes, but you will likely need to consult an attorney for help. You will also need to file an Affidavit of Heirship with the County Clerk where the deceased lived.